We provide secure transfer with easy onboarding

Our Process

KYC Verification

Importance of KYC

Protects against fraud, ensures secure transactions, and meets regulatory compliance for cross-border payments.

Required Documents

Upload a government-issued ID (e.g., passport, driver's license), proof of address (utility bill or bank statement), and take a live selfie for biometric verification.

Submission Process

Ensure documents are valid, clear, and well-lit for smooth processing.

Processing Time

Verifications typically take up to 24 hours to complete.

Tips for Success

Use natural light for photos, double-check details, and avoid submitting expired documents.

Add Recipient

Essential Details

Provide the recipient's full name, bank account number, IFSC code, and optional bank name/branch details for INR transactions.

Contact Information

Include an email or phone number to notify the recipient about the transfer.

Save Recipients

Add frequently used recipients to your address book for faster future transactions.

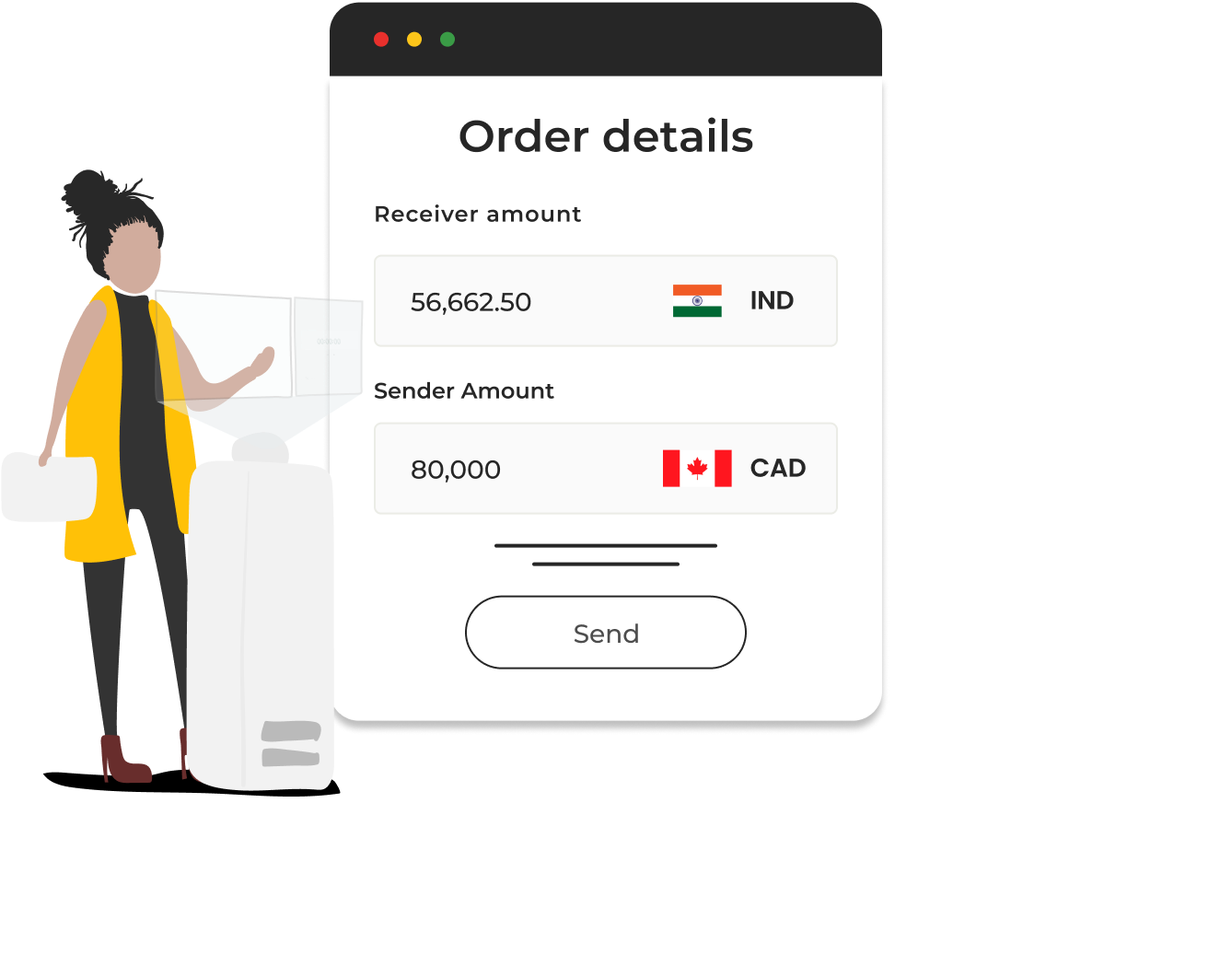

Confirm Order details

Verify Details

Confirm recipient's name, bank account, contact, exchange rate, and transfer fee.

Delivery Estimate

Check the expected delivery time (e.g., "2-4 business hours").

Optional Additions

Select the purpose of transfer or add a note for the recipient.

Final Confirmation

Ensure all details are correct with a "green checkmark" before proceeding.

Money Sent

Payment Process

Funds are securely debited, converted at the locked-in rate, and sent to the recipient's bank.

Notifications

Receive updates at every stage of the transaction.

Support Available

Contact the proactive support team for any assistance or issues.

Money Received

Recipient Notified

The recipient receives a bank notification, and funds are credited in INR instantly.

Your Confirmation

A receipt with transaction ID, amount, and date is available in the app.

Easy Access

Download or share the receipt for your records effortlessly.